Amendment 2 Could Save Florida Tax Payers $700 Million

May 15th, 2018 by Jake StofanA new report says a constitutional amendment slated for the November ballot could save Florida tax payers $700 million each year if approved.

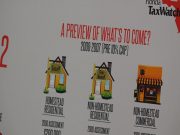

Amendment 2 would make permanent a 10% cap on annual non-homestead property tax increases that was implemented by a constitutional amendment in 2008.

The current cap is set to expire at the start of next year.

While the exemption doesn’t directly benefit homeowners, its repeal could impact living costs for renters and seniors on a fixed income according to the report.

“You know a recession is when your neighbor’s out of a job, a depression is when you’re out of a job and so you say, well what is it going to affect me? Well, if it’s affecting someone and it’s on a fixed income, it affects them pretty bad,” said Florida TaxWatch President, Dominic M. Calabro. “So people will go, ‘oh don’t worry it’s only an extra $10 a month.’ For some people that’s very hard.”

Prior to the 2008 amendment’s passage non-homestead properties were subject to massive tax hikes.

In 2006 30% of non-homestead properties saw a property tax increase of 80% over the previous year.

Posted in State News |  No Comments »

No Comments »