Citizens Rates Could Skyrocket

May 17th, 2012 by Mike VasilindaOn the eve of hurricane season, Citizens, the state run insurer of last resort, is considering dramatic rate increases to try and make private insurance companies more attractive and lessen the risk for taxpayers.

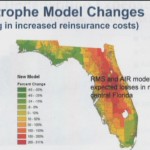

Sunshine State Insurance executives left the Capitol Thursday after making their case for a 17 percent rate hike. They have 45 thousand policyholders. The company faces higher reinsurance costs because new models show a bigger risk inland than in years before.

Sunshine is one of twenty two companies who, since the first of the year, have asked for rate hikes larger than ten percent. State regulator Bob Lee says many of the hikes are justified.

“It’s a combination of reinsurance, expected hurricane losses from the model, non hurricane losses from the model–sinkholes are a particular one,” Lee said.

But while everyone else is asking for double-digit rat hikes, Citizens, the state run insurer of last resort, is limited to just ten percent increase each year. Legal advisors are now telling the company it can begin charging new customers actuarially sound rates. That could mean 18 percent hikes inland and fifty percent on the coast.

“Anyone who wrote new business after the effective date of the rates would then, new customers would have the full rate,” Christine Ashburn with Citizens Insurance said.

If Citizens actually goes through with charging rates that are financially sound, what the company will be saying is, “Stop! you don’t want to do business with us; go somewhere else!”

A Citizens committee discussed the rate hikes in a conference call on Thursday.

“The new business rates aren’t capped as we understand the law,” Citizens Insurance President Tom Grady said.

Citizens board could vote on the higher rates as early as June.

Last year, the Office of Insurance Regulation approved 45 rates hikes for private insurance companies that were greater than ten percent, some of them as large as thirty five percent.

Posted in Hurricane Season, Insurance, State News |  1 Comment »

1 Comment »